As a student at the Graduate School of the University of Washington in the USA, what first struck the then 28-year-old Antony Natif was the quality of healthcare in the…

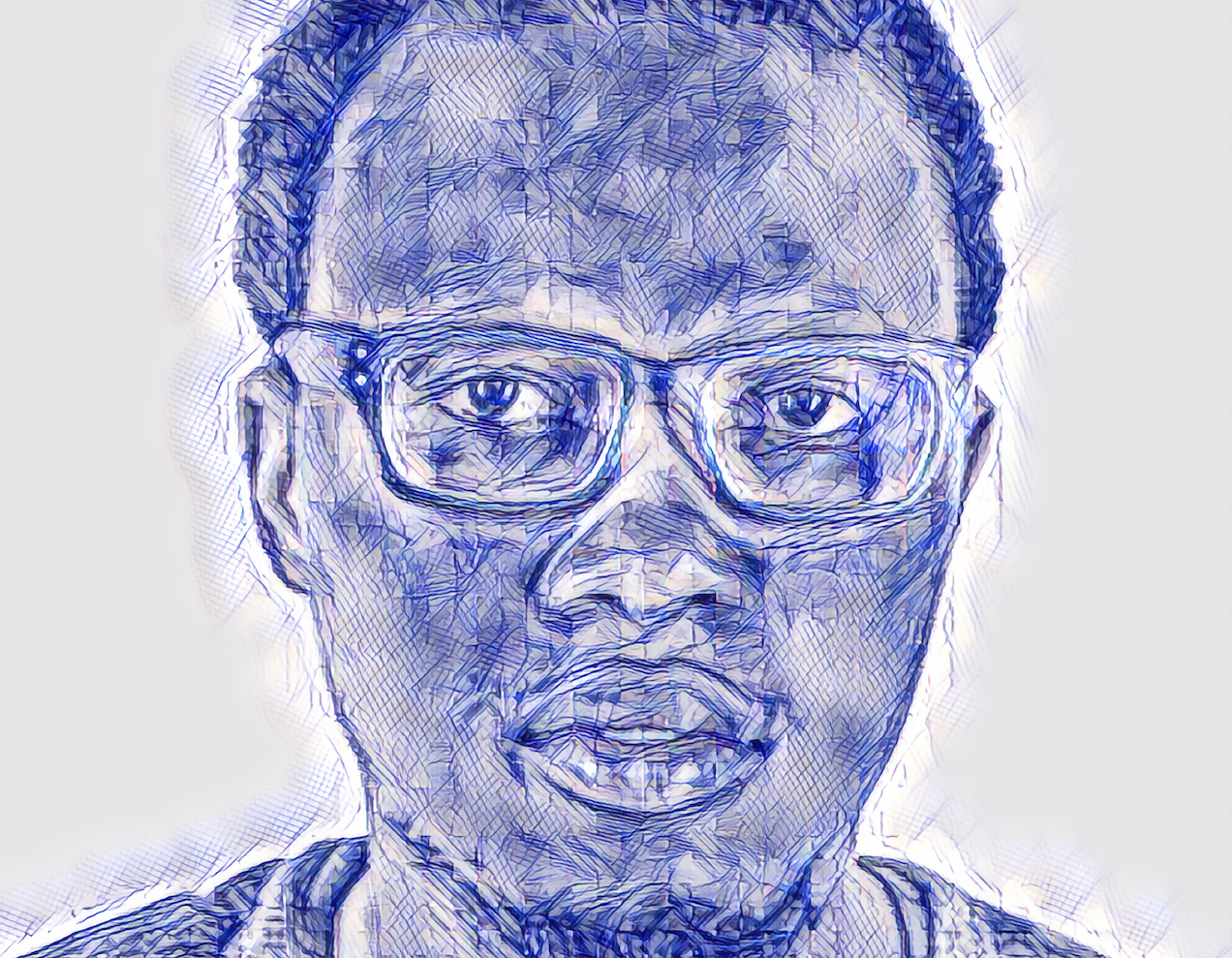

Who is Anthony Natif, the pharmapreneur behind Guardian Health- one of a few Ugandan million-dollar private equity exits