Ibrahim BbossaIt is important for anyone in Uganda’s entertainment industry to understand their tax obligations. This includes artists, musicians, and writers who are required to pay taxes on their earnings…

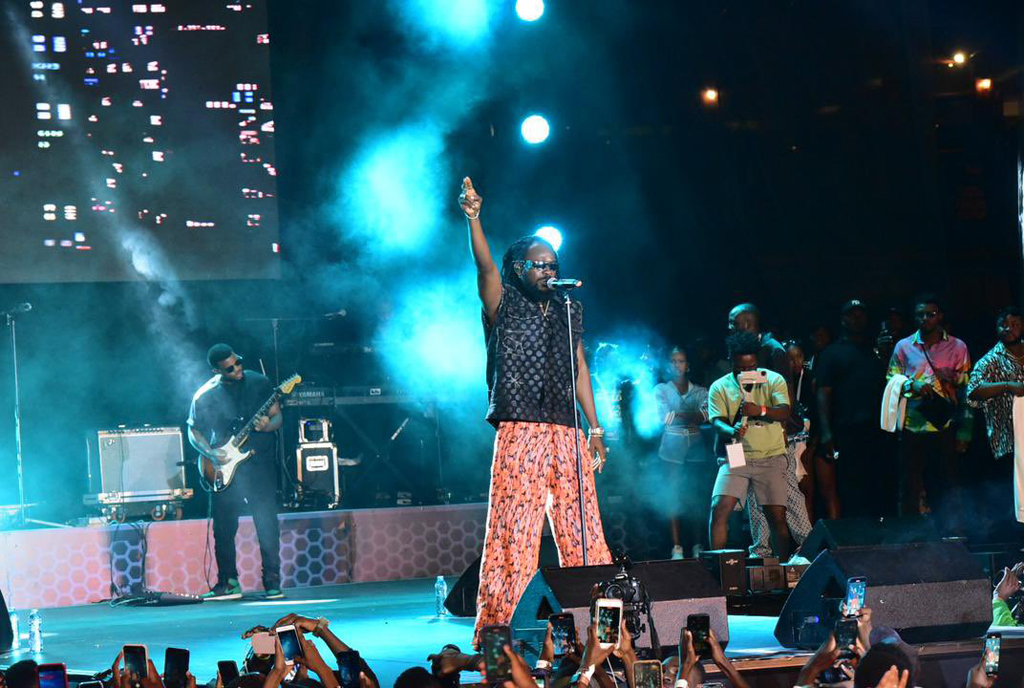

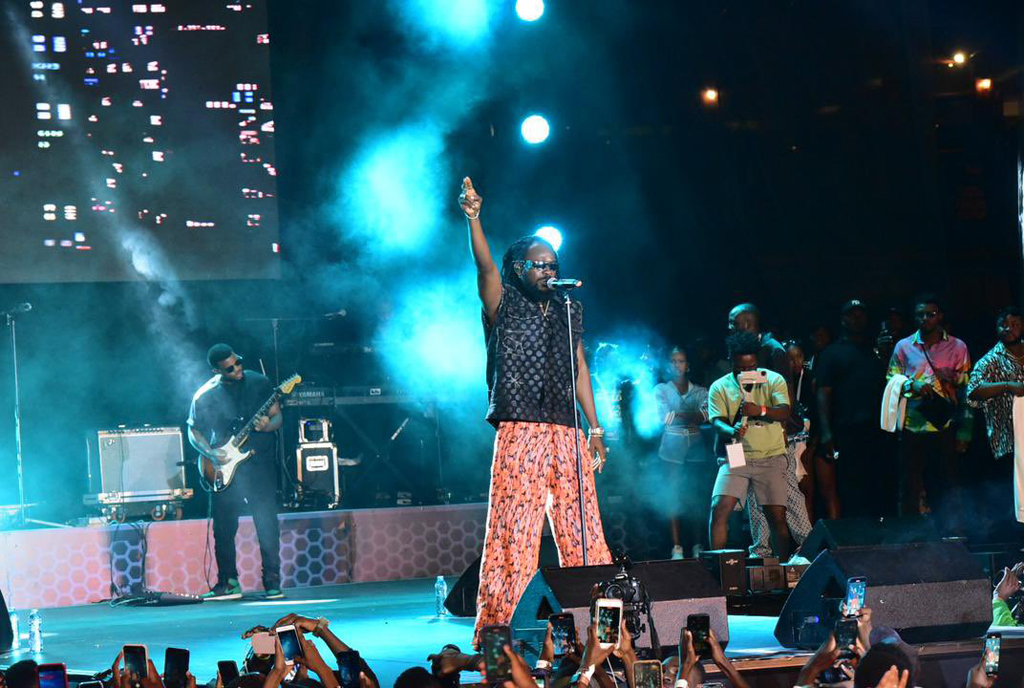

URA: Why artistes must pay taxes

Ibrahim BbossaIt is important for anyone in Uganda’s entertainment industry to understand their tax obligations. This includes artists, musicians, and writers who are required to pay taxes on their earnings…

deneme bonusu veren siteler deneme bonusu veren siteler deneme bonusu veren siteler deneme bonusu veren siteler deneme bonusu veren siteler casino siteleri

deneme bonusu bonus veren siteler deneme bonusu veren siteler

flyjota.com Deneme bonusu veren siteler Deneme bonusu veren siteler Deneme bonusu

gaziantep escort,alanya escort,gaziantep escort

avrupa yakası escort,beşiktaş escort,beyoğlu escort,nişantaşı escort,etiler escort,esenyurt bayan escort,beylikdüzü bayan escort,avcılar bayan escort,şirinevler escort,ataköy escort

beylikdüzü escort ,istanbul escort ,beylikdüzü escort ,ataköy escort ,esenyurt escort ,avcılar escort ,bakırköy escort ,esenyurt escort ,esenyurt escort ,avcılar escort ,beylikdüzü escort