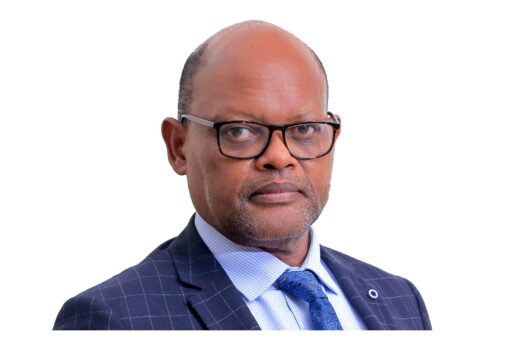

Cephas is a founder and the Managing Partner of Birungyi, Barata & Associates. He is an Advocate of the High Court, a commissioner for Oaths, a Notary Public and a registered Tax Agent with the Uganda Revenue Authority. He is also the head of the Tax Cluster in the Uganda Law Society and a member of the IBA Tax Committee.

Founded in 2003, Birungyi, Barata & Associates (BBA) is Uganda’s leading tax law firm. It is recognized both locally and internationally by entities such as Uganda Law Society, East African Law Society, IFLR1000, Chambers & Partners and Global Law Experts among others. The firm wields over 240 years of combined tax and commercial law experience. The firm has approximately handled 35% of all tax litigation in Uganda, including some game-changing cases that have resulted in tax law being amended.

The Firm offers bespoke advisory services on domestic and international tax, tax litigation, planning, audit and consultancy among others.

BBA has been involved in negotiating double taxation agreements on behalf of the Government of Uganda and drafting tax legislation. It has also carried out a number of consultancy assignments within Uganda for various ministries and government bodies, and outside Uganda for the EAC Secretariat, Trademark Africa, GIZ, IFC, AFDB, the World Bank, Rwanda, Liberia, Nigeria and Malawi.

Currently, the firm is headed by Birungyi Cephas Kagyenda, the Managing Partner in charge of the Tax and Litigation Departments, and Enoch Barata, the Senior Partner in charge of the Commercial Law and Banking Department.

Cephas has over 35 years of experience in tax and 17 years in legal having served in various capacities. He worked for the Ministry of Finance from 1984 and later on Uganda Revenue Authority where he retired as the Deputy Commissioner in 2004. He represented Uganda in negotiations and drafting of various double taxation agreements for South Africa, India, Denmark, Mauritius and Norway. He was also instrumental in drafting the Income Tax Act 1997 in Uganda and the Tax Appeals Tribunal Act.

Since 2004, Cephas has emerged as the best tax lawyer in Uganda and has been ranked by the IFLR1000, Chambers and Partners as well as Global Law Experts; and has offered his professional services to East Africa Community, the World Bank, International Finance Corporation Consultancies for the Malawi, Liberia, Nigeria (Bauchi State) Governments among others.

Cephas has carried out several advisory, consultancies and also litigation for individuals, private, public, NGOs and Government bodies. He has made several presentations to ICAU, CATA, DANIDA, World Bank, International Bar Association, and Uganda Law Society among others.

He is a member of the Uganda Law Society; East African Law Society, International Bar Association, IFSIN and Institute of Corporate Governance.

Publications and articles

Cephas edited tax publications for Paul Frobisher’s Book: Value Added Tax in Uganda: A Commentary on Statutes, Case Law and Practices; Pius Bahemuka’s Book: Income Tax in Uganda; and Christine Mugume’s book: Managing Taxation in Uganda.

He also was key in drafting and editing the compendium of cases, A compendium of tax cases by Birungyi, Barata & Associates, 2nd Edition. He is also a regular contributor to Thompson Reuters (Tax).

He holds an LLB from Makerere University and a Diploma in Legal Practice from Uganda’s Law Development Centre. He is a member of the Uganda Law Society, the East African Law Society, the International Bar Association and the Institute of Corporate Governance of Uganda.

Diageo to Exit East African Breweries as Asahi Takes Control

Diageo to Exit East African Breweries as Asahi Takes Control