East Africa is the fastest-growing economic region on the continent. In 2022, Uganda, Kenya and Tanzania attracted over USD13.3 billion worth of foreign direct investment (FDI). This is according to the latest investment report by the business advisory firm Ernst & Young.

The report singled out Uganda as having received USD10.2 billion — the highest in East Africa — creating 6,300 jobs. However, a refusal by a Ugandan Commercial Court to respect and enforce a London Court of International Arbitration (LCIA) ruling has turned on the stage lights onto Uganda’s investment climate and may position the country in a bad light, in the eyes of current and future foreign investors.

This move by a Ugandan Commercial court has lifted a lid on the recent battles pitting local and foreign investors that have led to lengthy and costly arbitral proceedings before local courts, the LCIA and the International Court of Arbitration of the International Chamber of Commerce (ICC).

This situation if not checked, may torpedo the Government’s efforts to attract foreign direct investments in Uganda.

The ruling by the High Court in Arbitration Causes No.0002 and 0005 of 2023 (consolidated), went contrary to the Convention on the Recognition and Enforcement of Foreign Arbitral Awards by failing to recognise the entire award as binding and enforceable.

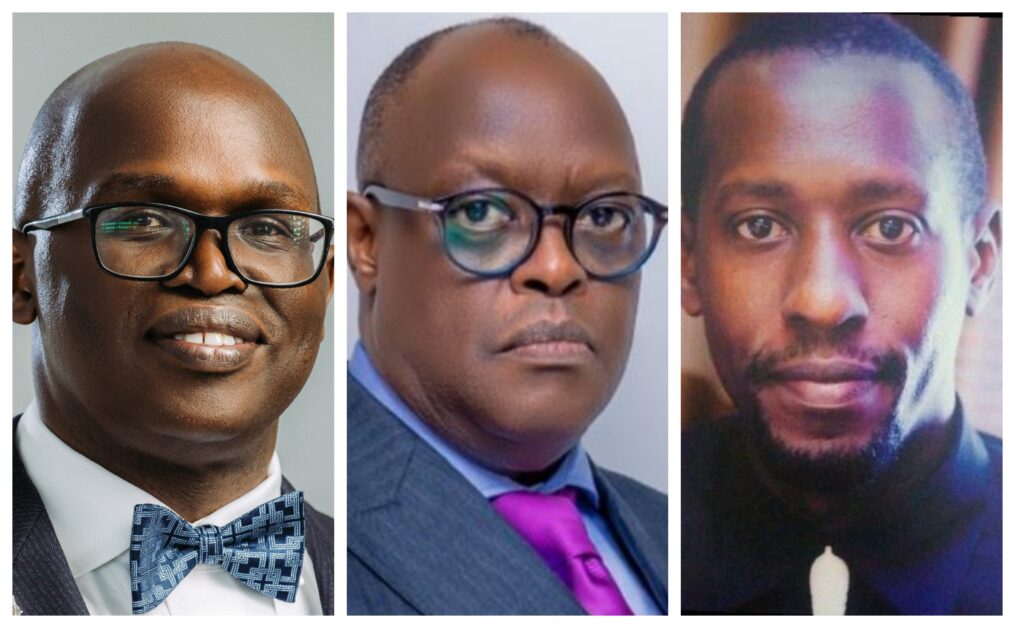

The matter evolved out of a commercial dispute involving Great Lakes Energy Company NV (Great Lakes), a Dutch-registered company, that invested more than USD20 million in a 20MW solar power plant in Kabulasoke, Uganda. They have been battling the investee company, Mss Xsabo Power Limited and its owner, Dr. David Alobo who was found by the LCIA to have fraudulently taken away Great Lakes shares in Mss Xsabo Power Limited and misappropriated company funds. Regardless of the LCIA awards, in 2023, the Ugandan High Court ruled that certain elements of the arbitral awards are unenforceable in Uganda. This means after investing more than USD20 million in Uganda, Great Lakes Energy Company NV is yet to benefit from investing in the power project.

For parties in dispute, the hallmark of arbitration is the finality in the resolution of disputes, guided by non-interference and automatic enforcement by national courts of signatory states. However, exceptions are made in cases where obvious exceptional errors have been discovered.

International investors and lenders have particularly relied on this core principle to confidently invest in jurisdictions other than their own. Altering this could have far-reaching consequences on the investment climate and reputation of Uganda, as well as affect the flow of capital – both investments and credit, especially if left uncorrected.

Commercial disputes in the news

In the recent past, there have been several other commercial disputes that have been in the news in Uganda. They include the all too familiar USD35 million Vantage Mezzanine Fund II Partnership against businessman Patrick Bitature and his companies as well as the USD11 million matter of Ham Enterprises Limited, Kiggs International (U) Limited and Hamis Kiggundu v. Diamond Trust Bank (U) Limited and Diamond Trust Bank (K) Limited (High Court Civil Suit No. 43 of 2020).

Another more familiar one is the USD165 million Aya Investments (U) Limited v Industrial Development Corporation of South Africa Ltd (2023).

Francis Gimara, the Head of Alp East Africa, an East African regional corporate and commercial law firm says the above commercial disputes, given their size and media attention, have cast Uganda in a bad light and will have negative consequences on the free movement of capital.

“All in all, the above disputes have implications on the free movement of capital, a key facet of efforts at positioning trade integration in Africa. The Free movement of capital includes direct investment operations (e.g., shares in Mss Xsabo) and credit operations (e.g., loan facilities to Aya, Ham and Simba). Crucially, the investments entailed in these disputes have been in critical areas of infrastructure (construction, energy, etc.) and services (hospitality),” Mr. Gimara notes.

Kabulasoke Power Plant

In the case of Kabulasoke, Great Lakes, accuses Dr. David Alobo of trying to defraud it of its shareholding in the investee company, as well as steal money lent to the project, denying its rightful share of the benefits from a 20-year power purchase agreement with the government of Uganda. The ensuing dispute, saw the parties enter a lengthy and costly arbitration process at the LCIA.

During the arbitration, the LCIA confirmed Great Lakes was the majority shareholding in the project. It also ruled that all the agreements entered between Great Lakes, Dr. Alobo and his associated companies were valid and enforceable, therefore confirming Great Lake’s 60% shareholding in Mss Xsabo Power Limited.

Further, the LCIA went ahead to order the transfer of these 60% shares to Great Lakes. Dr Alobo had unilaterally transferred Great Lakes’ shares in Mss Xsabo Power to his companies in 2019.

The High Court in Uganda, while acknowledging the LCIA order requiring the transfer of shares in Mss Xsabo, to give Great Lakes its entitlement of 60% shareholding, ruled that doing so is contrary to public policy, as it fetters the discretion of Uganda’s Electricity Regulation Authority (ERA), a public body entrusted with licensing and approving a change of control.

Additionally, the High Court took the view that the issue regarding the shares already held by Great Lakes was already before the High Court and the Registrar of Companies in Uganda but was yet to be concluded.

Based on this, the court held that the order by the LCIA tribunal was contrary to public policy as it conflicted with local judgment on a matter that similarly touched on public policy.

Lastly, the courts considered the LCIA decision to be contrary to public policy as it would compel the continuance of an acrimonious and bitter relationship between Great Lakes on the one hand and Dr. Alobo and his companies on the other hand, that would require constant monitoring and supervision of the courts.

Impact on Uganda’s investment climate

According to the Judiciary’s Annual Performance Report FY 2022/2023, at the close of the financial year, of the 156,349 cases in the system, 42,960 cases (27.48%) were backlog⏤ cases older than two years in the system.

The Commercial Court Division and the Court of Appeal where Great Lakes’ appeal will be heard, have some of the highest backlog rates⏤ at 33.4% and 59% respectively. Case backlogs in the Supreme Court stood at 46.5%.

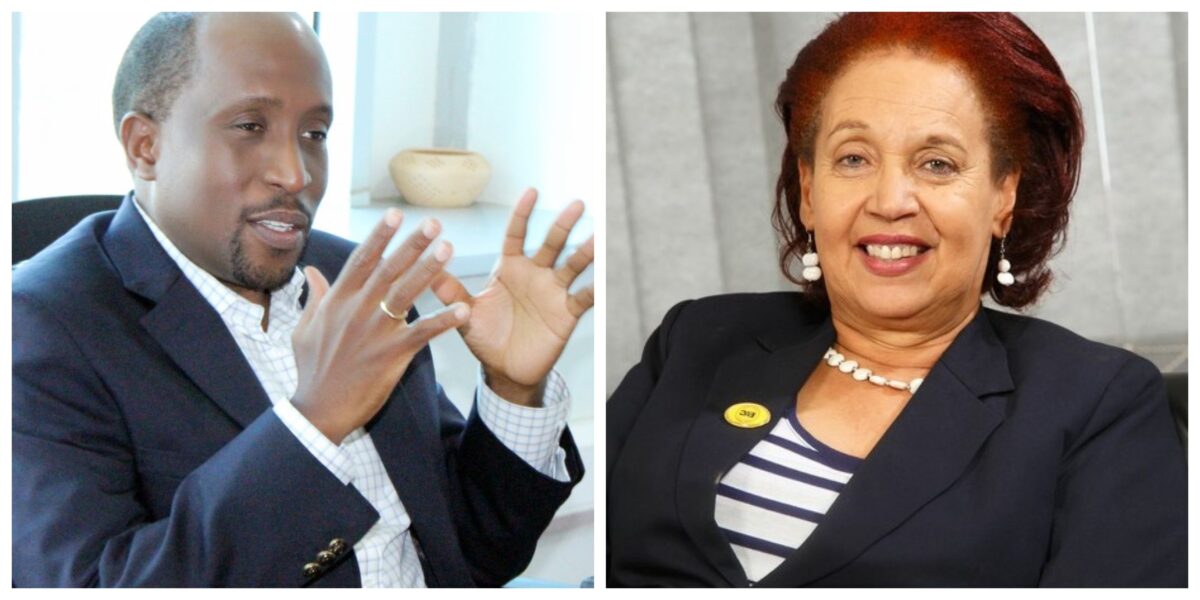

Andrew Muhimbise, a regular commentator on Uganda’s financial markets says some of these cases are a matter of “some indigenous investors sometimes hiding behind legal loopholes in our system and their knowledge of the landscape to buy time to play games. Investors will be reluctant to come into a system where they know they cannot readily and speedily get redress in case of a business dispute”.

“The legal processes should be expedited, because justice delayed is justice denied,” Mr. Muhimbise concludes.

Stephen Kaboyo, the Managing Director Alpha Capital Partners, says that Uganda has earned itself an unenviable reputation as “a risky destination for foreign capital”.

“In the lenses of foreign lenders, Uganda is flagged as a country with weak institutional and legal systeMssS, particularly in enforcement of contracts, protection of property rights and effective functioning of the judiciary as tested by these recent cases,” Kaboyo explains.

“Going forward, strengthening national institutional and investment frameworks is necessary to repair the dented image and regain the goodwill of foreign lenders,” Kaboyo concludes.

Not all is lost

Phillip Karugaba, a Ugandan Partner at Africa-wide law firm, ENS Africa however believes all is not lost. “There will always be commercial disputes. The size of the disputes is just growing with the economy. These cases show that the dispute resolution mechanisMssS in Uganda work. We have a solid Commercial Court. We recognise foreign arbitral awards. The Commercial Court has done us proud in several of the decisions made in these cases. The court has shown independence, impartiality and commercial awareness,” he says.

Dr. Maggie Kigozi, an industrialist, commercial farmer and former Executive Director of Uganda’s Investment Authority (UIA) is convinced that the above major disputes are isolated incidents.

“Many successful projects have been funded by both local and international funders. The media prefers negative news, and the successes are not reported well enough,” she says, adding: “I want to believe that the investors are getting this other side of the story where investors in telecoms, manufacturing, financial institutions, agriculture, education, health, ICT, the creative industry and our numerous SMEs are being financed and succeeding to pay back and become profitable.”

Another chance

Great Lakes is before the High Court Commercial Division this month seeking recognition and enforcement of yet another arbitration award in its dispute with Dr Alobo. In its latest award, following Great Lakes allegations of embezzlement of funds in the Kabulasoke project by Dr Alobo and his companies, the LCIA found that Dr Alobo diverted funds amounting to USUSD 8.66M from Mss Xsabo Power and spent it on activities were outside the normal course of business. It remains to be seen if this new arbitration award will be recognised as binding and enforceable by the Courts. The new case will help or hinder Uganda’s image and reputation with foreign investors.

Tight Rules, Big Money: Energy Ministry Restricts Gold Trade to Licensed Operators as Central Bank Enters a UGX 20 Trillion Market

Tight Rules, Big Money: Energy Ministry Restricts Gold Trade to Licensed Operators as Central Bank Enters a UGX 20 Trillion Market