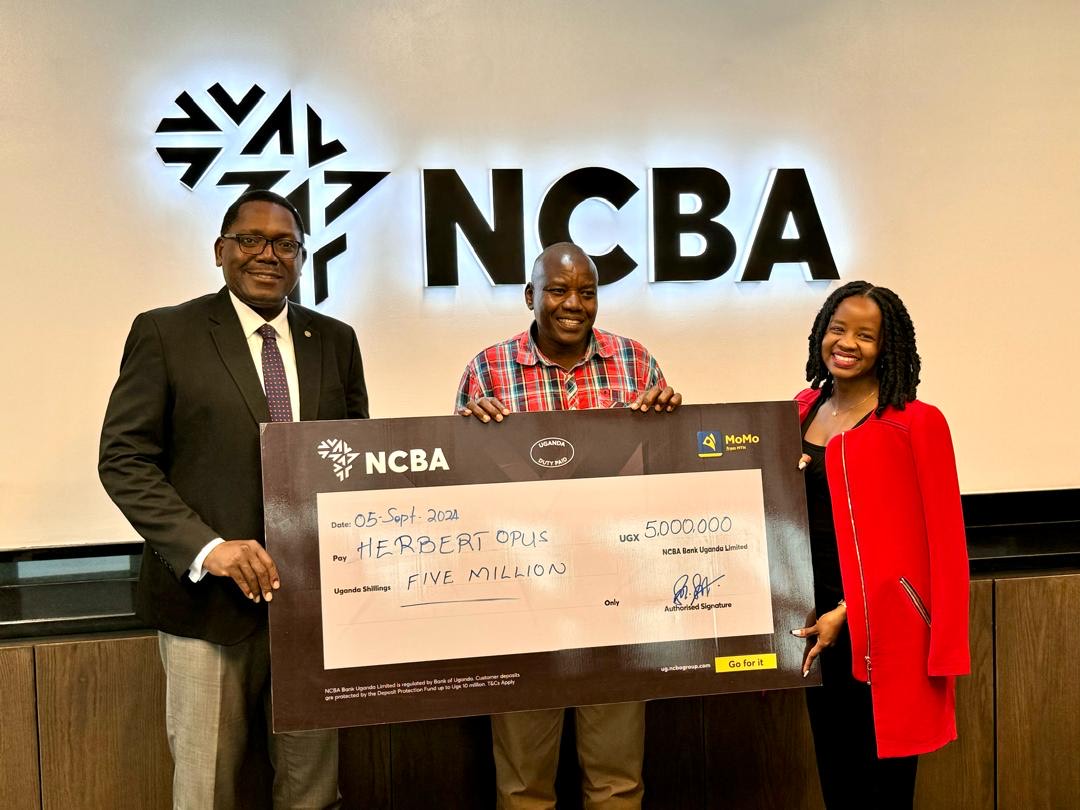

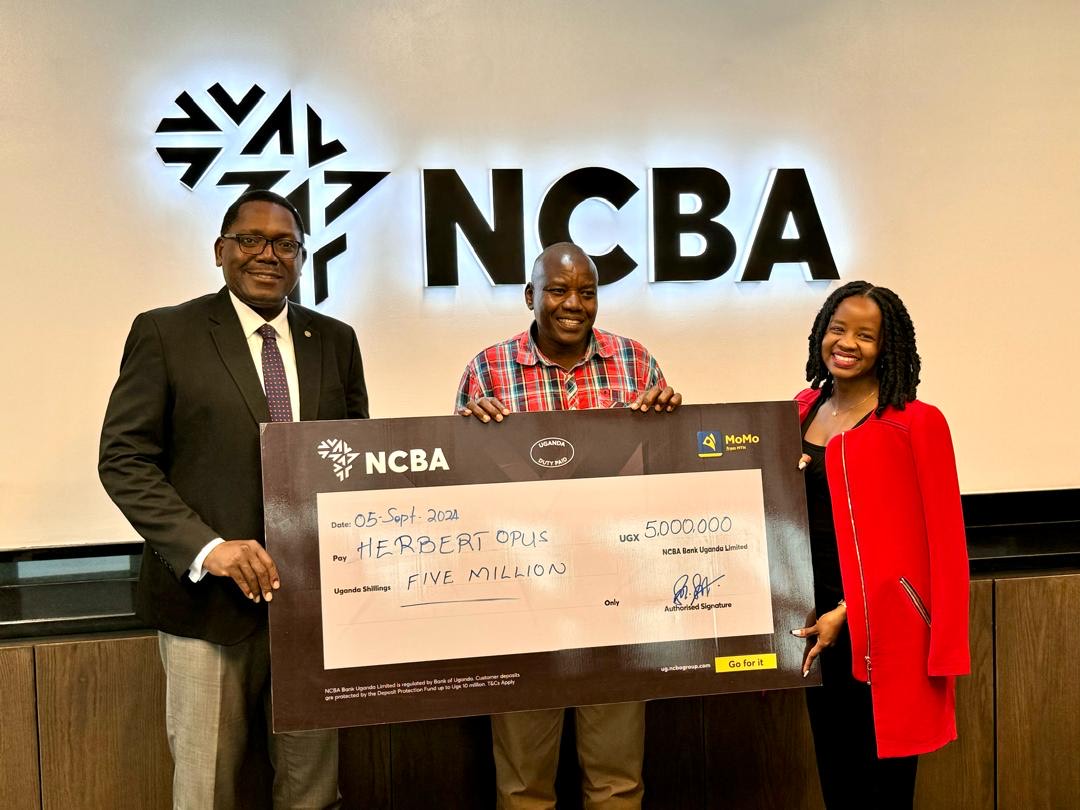

NCBA’s Mo Money with MoKash campaign has reached a thrilling end with grand prizes awarded to three lucky winners, at the bank’s head offices in Kampala.Each of the three winners…

NCBA, MTN-MoMo give UGX 65 million in Mo Money with MoKash campaign

NCBA’s Mo Money with MoKash campaign has reached a thrilling end with grand prizes awarded to three lucky winners, at the bank’s head offices in Kampala.Each of the three winners…

deneme bonusu veren siteler deneme bonusu veren siteler deneme bonusu veren siteler deneme bonusu veren siteler deneme bonusu veren siteler casino siteleri

deneme bonusu bonus veren siteler deneme bonusu veren siteler

flyjota.com Deneme bonusu veren siteler Deneme bonusu veren siteler Deneme bonusu

You cannot copy content of this page

gaziantep escort,alanya escort,gaziantep escort

avrupa yakası escort,beşiktaş escort,beyoğlu escort,nişantaşı escort,etiler escort,esenyurt bayan escort,beylikdüzü bayan escort,avcılar bayan escort,şirinevler escort,ataköy escort

beylikdüzü escort ,istanbul escort ,beylikdüzü escort ,ataköy escort ,esenyurt escort ,avcılar escort ,bakırköy escort ,esenyurt escort ,esenyurt escort ,avcılar escort ,beylikdüzü escort