The Uganda shilling was relatively volatile as it responded to the demand and supply imbalances in the market. Investor sentiment and trading moves were see-sawing most of the sessions. Trading was in the range of 3510/20.

In bond market, BOU converted UGX345.9 billion that were due to mature in June extending the maturities to 2023 and 2040. The market response was overwhelming, bids in excess of 570 billion were received. The rationale behind the conversions was to manage lumpy maturities and ease government cash flows.

In the regional markets, the Kenya shilling held steady ahead of the sale of the infrastructure bond later this month which is likely to attract significant portfolio flows.

In the global markets, the US dollar rose after higher than expected inflation numbers at 7.5% and hawkish comments from the Federal Reserve unleashed a wave of bets on aggressive rate hikes while in other markets similar pressures kept a lid on gains.

In energy markets, oil prices climbed after session of losses as industry data showed an unexpected drop in US crude stocks offsetting concerns of possible rise in supplies from Iran.

Outlook for the shilling indicate range bound trading as the unit struggles to find momentum and any real direction.

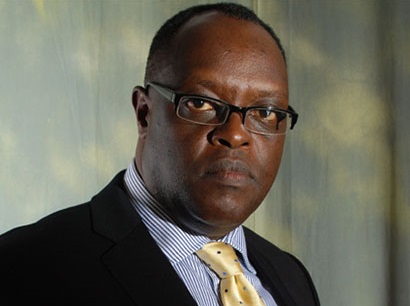

January 4 – February 11, 2022: Weekly financial markets review and outlook with Stephen Kaboyo

Stephen Kaboyo, Founder and Managing Director Alpha Capital Partners