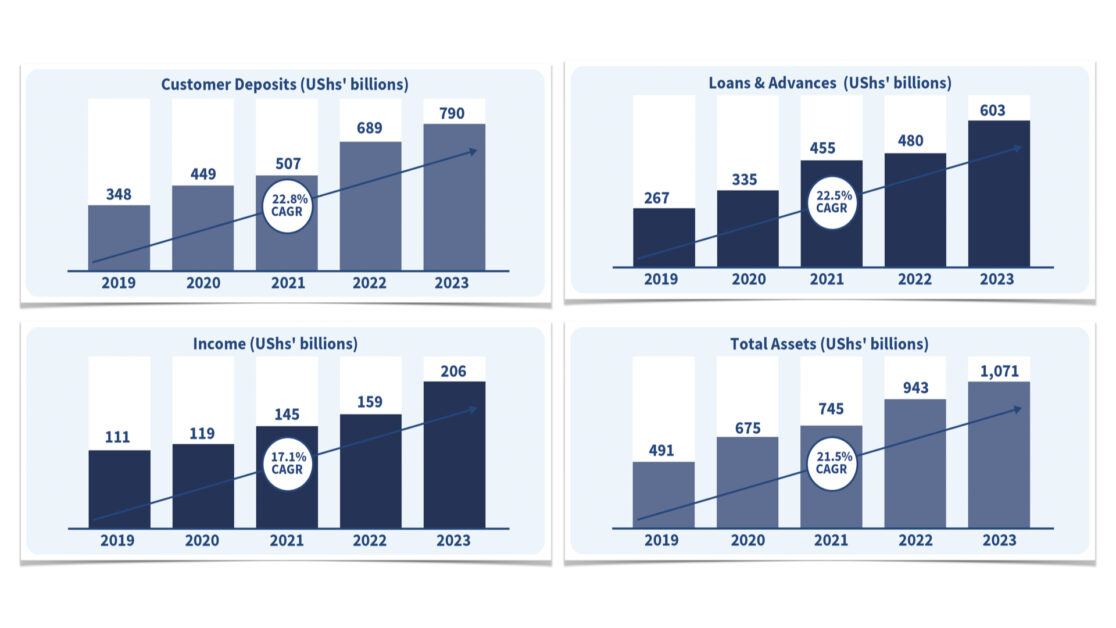

Two years, after being granted a tier one commercial banking license in December 2021, assets of the government-owned PostBank Uganda (PBU) in 2023 crossed the UGX1 trillion mark, reaching a record UGX1.071 trillion.

Results released this week, show that total assets grew by 14% from UGX943 billion to reach UGX1.071 trillion, a growth of UGX128 billion.

This, according to Julius Kakeeto, the bank’s Managing Director / CEO, was on the back of double-digit growth and “above-industry-average growth rates” in deposits, lending and subsequently income and net profits.

Lending grew by 26% from UGX480 billion in 2022 to UGX603 billion, a growth of UGX123 billion. Customer lending constituted 56% of the bank’s asset book.

The biggest growth in lending was in the MSMEs and agriculture value chain, the bank said.

The lending was boosted by a 15% growth in customer deposits, from UGX689 billion to UGX790 billion; a growth of UGX101 billion. Subsequently, the bank’s income grew by 30% from UGX159 billion in 2022 to UGX206 billion in 2023; a growth of UGX47 billion.

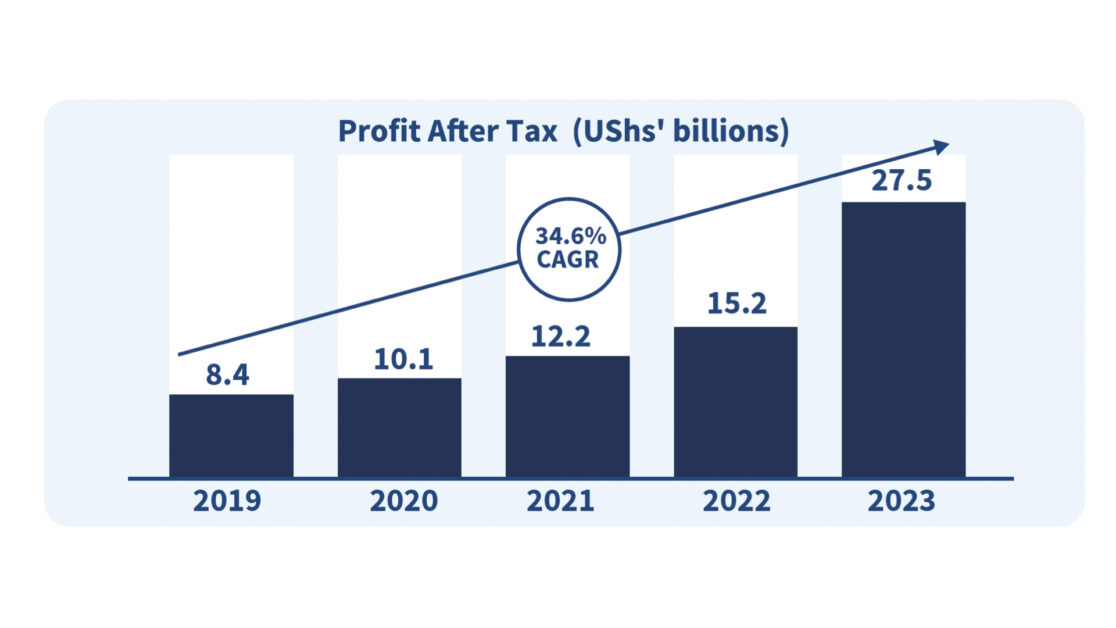

An increase in income combined with a slower growth in expenses, saw the bank declare a net profit of UGX27.5 billion.

“We closed the year with a profit after tax of UGX27.5 billion reflecting a growth of 82% from the UGX15.2 billion earned the previous year. This reinforces the bank’s capital position as it prepares itself for the new minimum capital requirements that will take effect on 30th June 2024 and demonstrates the bank’s consistent improvement in its operations,” Kakeeto, explained at a press conference to announce the bank’s results, this week.

PostBank becomes one of only 14 banks with over UGX1 trillion in assets in an industry of over 22 banks. The other 13 banks are Stanbic Bank, Centenary Bank, Absa Bank Uganda, Standard Chartered Bank, Equity Bank, dfcu Bank, Bank of Baroda, DTB Uganda, Housing Finance Bank, Citi Bank, KCB Bank and Bank of Africa.

Facts behind the figures

Explaining the facts behind the 2023 figures, Kakeeto, who has been leading the bank’s transformation since becoming Managing Director / CEO in October 2019, attributed the steady growth, to the bank’s investment in people, technology and governance to bring about efficiency, competitiveness and a superior customer experience.

“The journey started more than four years ago and in that journey, we were very deliberate about where we wanted to focus. We thought and agreed at that time to scale up the governance of the bank. In governance, there are a lot of components in there⏤ the management team, the risk management practices and the policies that govern us and so on,” he said.

“We had to improve customer service, so the bank could compete with the other banks. We were behind in terms of technology. We started a digital transformation journey to bring our technology up to speed so that the service and experience that you get when you come to PostBank is very similar to the experience you get when you walk into any other bank or interact with any other bank,” Kakeeto who was flanked by Kabeera Andrew, the Executive Director and Chief Digital Financial Services Officer and Ssenyange Peter, the CFO added.

On the need to invest in people, Kakeeto said, “Banking is a service and a service of skill; immense skill. You must have the right skillset, and you must have the right people, for you to be able to to perform as a banking institution. That is very, very important. Because we sell/offer similar things across the banking industry- it’s a very competitive industry, one of the things that differentiates you from the others is the people that you have, and their skill and commitment”.

Faster-than-industry growth

The bank has between 2019 and 2023 invested UGX15.7 billion in technology as well as invested in the distribution network, putting up 12 new branches as well as refurbishing the existing 35 branches. UGX3.2 billion has also been invested in staff training.

To drive financial inclusion and serve the unserved and underserved, the bank invested UGX7 billion in the Wendi Mobile Wallet that was launched in November 2023.

Wendi can be used by anyone, both PostBank and non-PostBank customers⏤ retail customers, agents as well as groups and is accessible via multiple channels i.e., the web portal, a Mobile Application and USSD short code (*229#). The platform offers a bouquet of services which include a Groups’ and SACCOs’ management functionality, the ability to transfer funds within Wendi, to mobile money accounts (Airtel and MTN) as well as bank accounts, deposits, withdraws and savings for both individuals and group.

The savings solution therein enables users to save as little as UGX20,000/= and earn daily interest which is also paid out on a daily.

One of Wendi’s strengths lies in its ability to enable customers to self-onboard through both the Mobile App -Wendi and the USSD short code *229#.

So far, Wendi has enrolled over 200,000 beneficiaries and paid out UGX200 billion. It has also served over 4,700 SACCOs, out of whom, 2,400 are beneficiaries of the government of Uganda’s Parish Development Model (PDM). Altogether, Wendi presently serves over 480,000 customers.

“The results are now coming through, we closed the year at a net profit of UGX 27.5 billion. That is a record performance for PostBank. All figures are looking north. We’ve been growing faster than the industry average over the last four years, compared to other commercial banks. The service has significantly improved, despite the number of transactions going up and this is all because of technology,” Kakeeto reiterates, saying that today, only 20% of customers transact over the counter, compared to 80% four years ago.

“Four years ago, you would wait for six months to get an ATM card, you would line up to get a service. Those days are gone. We don’t have long queues in our branches. Because of technology a lot of our customers don’t have to physically come to the bank to interact with us,” Kakeeto says, adding that the target is to have up to 95% of all transactions happening outside the banking hall, driven by mobile banking, the Wendi Mobile Wallet and agency banking.

Looking forward and a new purpose⏤ Fostering Prosperity for Ugandans

Kakeeto said that having surpassed all the targets for its 4-year strategy, which came to a close at the end of 2023, the bank has embarked on a new 4-year plan with a refreshed purpose.

“We’ve been internally reviewing our strategies. Last year we refreshed our strategy that runs until 2028. One of the key questions we would like to address is how we can be more relevant to all our stakeholders and the people of Uganda. How can we be more impactful?” he explained.

He said that under the new strategy, the bank’s purpose has been upgraded from “Empowering You” to “Fostering Prosperity for Ugandans”.

“Our goals and a lot of what we’re going to do is going to be pointed towards “Fostering Prosperity for Ugandans,” he said.

Kakeeto also said that to meet the new UGX150 billion capitalisation requirements deadline of June 2024, the bank will at its May 2025 AGM seek permission to convert the profits into capital.

Letters to My Younger Self: Winnie Nakimuli—"You Are Worthy Simply Because You Exist"

Letters to My Younger Self: Winnie Nakimuli—"You Are Worthy Simply Because You Exist"