Uganda is set to host the 8th edition of the East Africa Venture Capital Association (EAVCA) Annual Private Capital Conference on the 13th of June 2024 at Speke Resort Convention Centre in Munyonyo.

“As we embark on the journey of defining the next era of East Africa’s investment landscape, the East African private capital landscape stands out as a beacon of resilience and opportunity. In the face of unprecedented global challenges, East Africa has demonstrated its ability to adapt and thrive, emerging as an increasingly attractive investment destination for private capital,” says a statement on the conference’s website.

The theme of the EAVCA Annual Conference 2024, “Adaptation and Advancement: Navigating the Next Wave of East Africa’s Investment Landscape,” seeks to “explore the dynamic interplay between embracing change, fostering collaboration and reimagining sustainable growth in the region amidst adversity,” according to the organisers.

“The EAVCA Annual Private Capital Conference is the premier in-person gathering for investment professionals and supporting industries across East Africa and beyond. The conference offers a unique platform for attendees to connect, network, share ideas and forge new partnerships with LPs, GPs, established business leaders, and industry experts,” the organisers further say.

“This year’s annual conference takes a forward-looking stance, looking at the trends that are shaping and that will shape East Africa’s private capital industry in the coming years, including growing interest in East African frontier markets such as Uganda, among others such as DRC, Rwanda, and Tanzania. The latter recognises rapidly changing global, regional, and country-specific macro contexts, which, in some cases, may necessitate a doubling down of strategies that have worked before and, in others, drawing up lessons and learnings from those that may require rethinking and retooling and moving forward as a means of adapting to a changing industry, and through the thought leadership discussions, charting the course for the next stage of private capital investing in East Africa. Besides serving as the regional platform for knowledge sharing and thought leadership, delegates should also expect a networking opportunity,” reads a statement on the conference website.

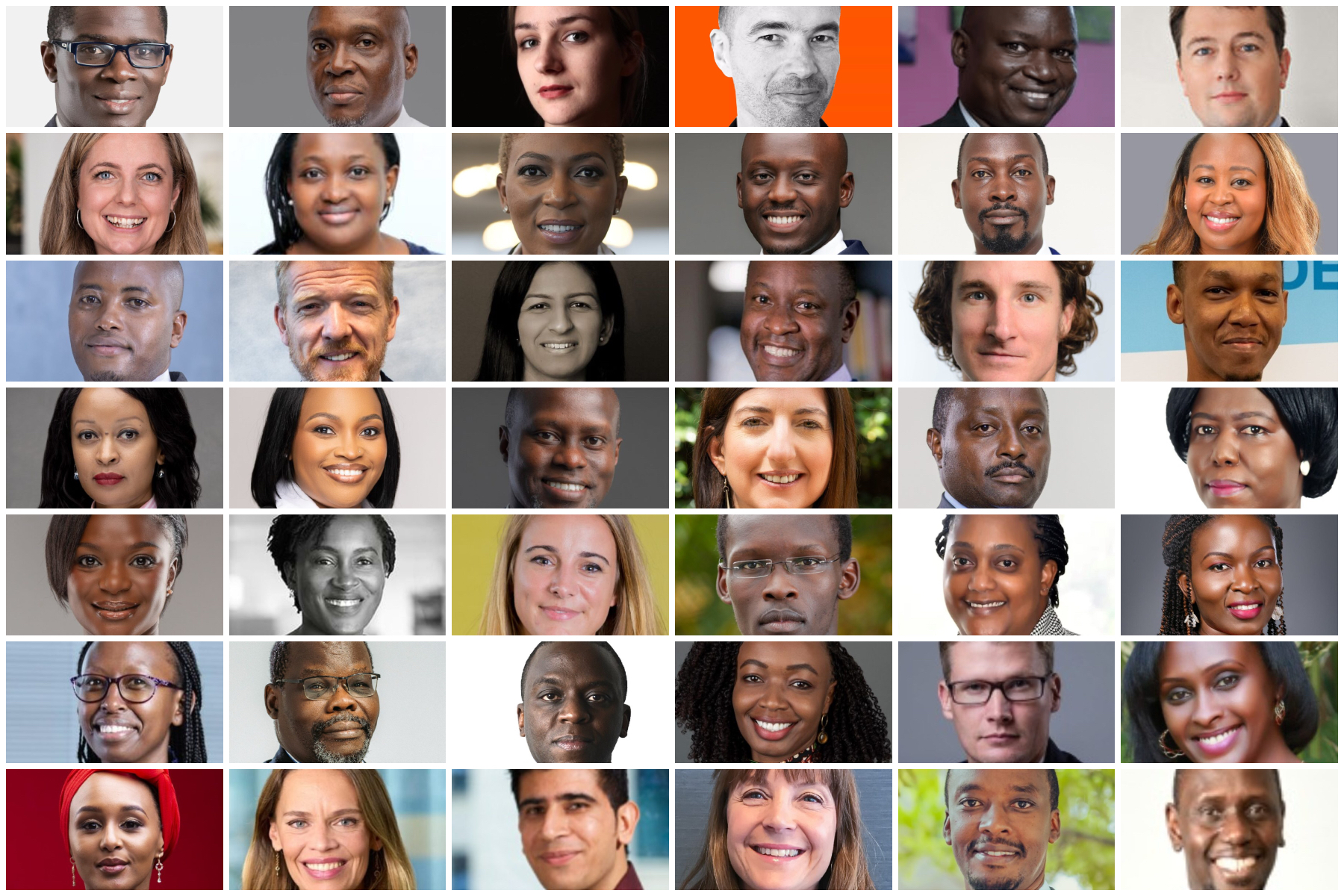

The event has attracted an impressive lineup of speakers, featuring the crème de la crème of Uganda’s private capital industry as well as prominent figures from the region and beyond. From Uganda, some of the speakers lined up include Agnes Aistleitner Kisuule, the co-founder and Managing Partner of First Circle Capital, Carol Birungi, the Country Manager and Director of XSML Capital, Mrs Mona Muguma Ssebuliba of aBi Finance, Dr Edward Isingoma Matsiko from Pearl Capital Partners, Kim Kamarebe of Inua Capital as well as David Owino and Richard Mugera, both from Ascent Capital.

Heavy hitters from across the region and beyond that are expected to attend include the CEO of the Nairobi Securities Exchange, Frank Mwiti, the regional director of SwedFund, Audrey Obara, the CEO of the African Business Angels Network (ABAN), Fadilah Tchoumba, the co-founder of I & M Burbidge Capital, Edward Burbidge and Eluid Maina, the structured investments Lead at Rwanda Social Security Board among others.

The East Africa Venture Capital Association (EAVCA) is the representative organisation for private equity and venture capital funds in East Africa. It was founded in 2013 to provide a voice for the private equity industry in the region and engage on policy matters.

EAVCA serves as a platform for public stakeholders, local businesses, and private investors to build dialogue and industry insights, intending to create a sustainable and informed ecosystem that advances economic growth, social and environmental welfare, and wealth creation in East Africa

EAVCA’s membership represents development finance institutions (DFIs), private equity and venture capital funds, family offices, impact investors, and other private capital providers supporting businesses and enterprises in the region

The association organizes various events, but the Annual Private Capital in East Africa Conference is its flagship event. The Annual Private Capital conference is organized in association with other partners. This year’s event has attracted partners like USAID, the British International Investment (BII), Bowmans, Dentons, Ugandan Development Bank, Ascent Capital and KPMG among a plethora of partners.

Some of the topics for the conference include:

- The Role of Development and Aid Agencies in Catalysing Private Capital Investments in East Africa.

- Holding down the Fort: The role of Funds with a Local Footprint and Understanding of local Nuances in expanding the Availability of nuanced Funding for High-risk Opportunities in East Africa.

- LP Perspectives- Bypassing the Middleman: Limited Partner (LP) co-investments and direct plays in East Africa.

- GP- Perspectives- Delivering exits and returns for Limited Partners (LPs): East Africa’s Fund Cohort of 2015/16- How is it going so far?

- Are Debt Funds the Future of Investing in East Africa? If so, where does that leave equity strategies?

- Rethinking the fixed-end private equity fund- The Evergreen Fund- Case Studies, Risks and Opportunities.

- The new missing middle: Chasing the early-stage and mid-private equity opportunity—Is there still investor appetite for growth-stage deals?

- What next for venture capital investments in East Africa amid shifting global market dynamics?

- Case Studies of Established Fund Managers with 2+ Successor Funds

- Exit routes and innovative value creation strategies: are Continuation Funds the emerging standard?

- Strategize to mitigate macro-complexities risks in exit planning

- Adapting exit strategies to address changing tax and regulatory frameworks

- EA. as a jurisdiction for the domiciliation of investment vehicles and funds

- The Race to Net Zero: Private Capital and Climate Finance – Feasibility, Challenges and Opportunities in Green Economy deals.

- Regulatory frameworks for green economy: Sector and National Taxonomies.

- The on-shore opportunity and the role of commercial banks and private capital market intermediaries in deal origination

- Cracking the code of achieving investor/ business owners’ alignment in private capital investments.

Tickets are already on sale with members paying $464 for entry, while non-members will have to part with $696. Tickets will also be available at $58 for entrepreneurs who have businesses of less than three years and are actively looking for capital from investors. You can purchase a ticket here.

Airtel Africa and SpaceX Announce Strategic Partnership to Launch Starlink Direct to Cell Connectivity Across Africa

Airtel Africa and SpaceX Announce Strategic Partnership to Launch Starlink Direct to Cell Connectivity Across Africa