Kenyan fintech powerhouse, Lipa Later Group, has successfully raised $5 million in a private debt issuance, marking a significant milestone in its financial journey. However, the company’s ambitious expansion plans require an additional $20 million, which it aims to raise through a combination of equity and debt.

Lipa Later is also in the midst of a crowdfunding campaign, seeking to raise $1.2 million in exchange for equity at a valuation of $30 million. This campaign is hosted on the crowdfunding platform, Republic.

Founded in 2018 by Eric Muli and Michael Maina, Lipa Later has made a name for itself in the fintech industry. The company offers a range of merchant solutions, including consumer credit, working capital, and e-commerce solutions. Its innovative Buy Now Pay Later (BNPL) product, which allows consumers to make purchases and pay for them in convenient instalments, has garnered widespread recognition.

Lipa Later’s mission is to empower African businesses by facilitating e-commerce, promoting financial inclusion, and offering a fully integrated and centralized shopping platform. Since its inception, the company has successfully secured $25 million in funding and operates in four key markets: Kenya, Uganda, Rwanda, and Nigeria. But as per its crowdfunding plans, Lipa Later plans to move into SME banking in 2024 to gain a Tier Two banking license.

The company’s recent achievement of raising $25 million in pre-Series A funding has significantly bolstered its expansion plans, allowing it to set its sights on a broader African presence. Lipa Later boasts an impressive customer base exceeding 350,000 individuals and collaborates with over 30,000 merchants. It has also forged an exclusive partnership with Mastercard for point-of-sale (POS) financing in East Africa.

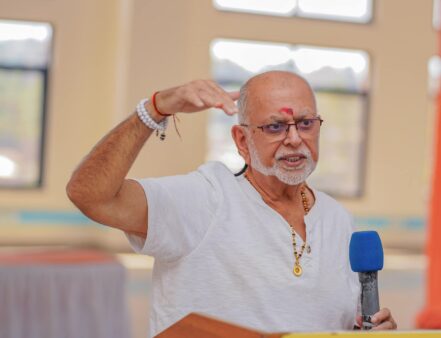

Despite the current challenging VC funding landscape, Lipa Later remains optimistic about its future. “With the support of our stakeholders and investors, we are confident that we can achieve our goal of making financing more accessible and inclusive for all,” said Eric Muli, the CEO and founder of Lipa Later.

The company’s $5 million debt issuance is a testament to its financial strength and investor confidence. However, Lipa Later has chosen to remain tight-lipped about the specifics of this issuance. As Lipa Later continues its crowdfunding campaign, the company is hopeful that it will secure the necessary funds to fuel its expansion plans.

Debt financing has become an option for startups raising funding due to the funding winter that has made big funding rounds unattractive, as most VCs hold onto the funds to wither the storm. Startups like Zofi Cash and M-Kopa have all raised det financing to propel their expansion plans. Unlike equity financing, debt financing is based on what a startup’s ability to pay back and that is why it makes sense for late-stage startups like Lipa Later and not seed or pre-seed startups.

Lipa Later was one of the first startups in Africa to jump onto the buy now pay later craze as a way of credit. In Uganda, they face competition from startups like Paylater Uganda and other startups that have it as an in-house function.

Beyond the Low-Hanging Fruit: The Grit, Capital, and Vision Required to Industrialise Rural Uganda

Beyond the Low-Hanging Fruit: The Grit, Capital, and Vision Required to Industrialise Rural Uganda