It’s no longer a question of what, but when. The government of Uganda says it will gradually phase out small denomination paper notes as one of the measures to reduce…

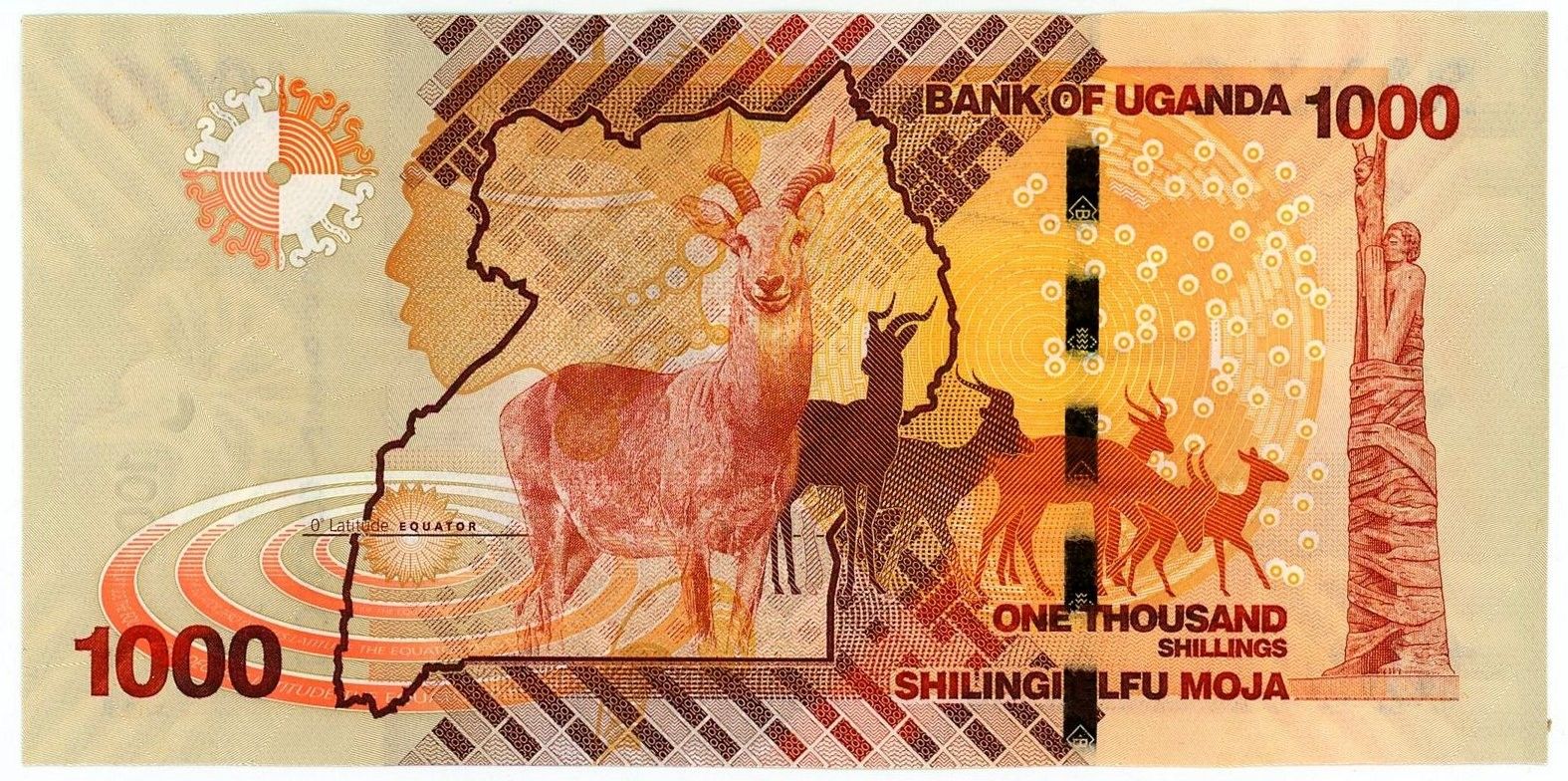

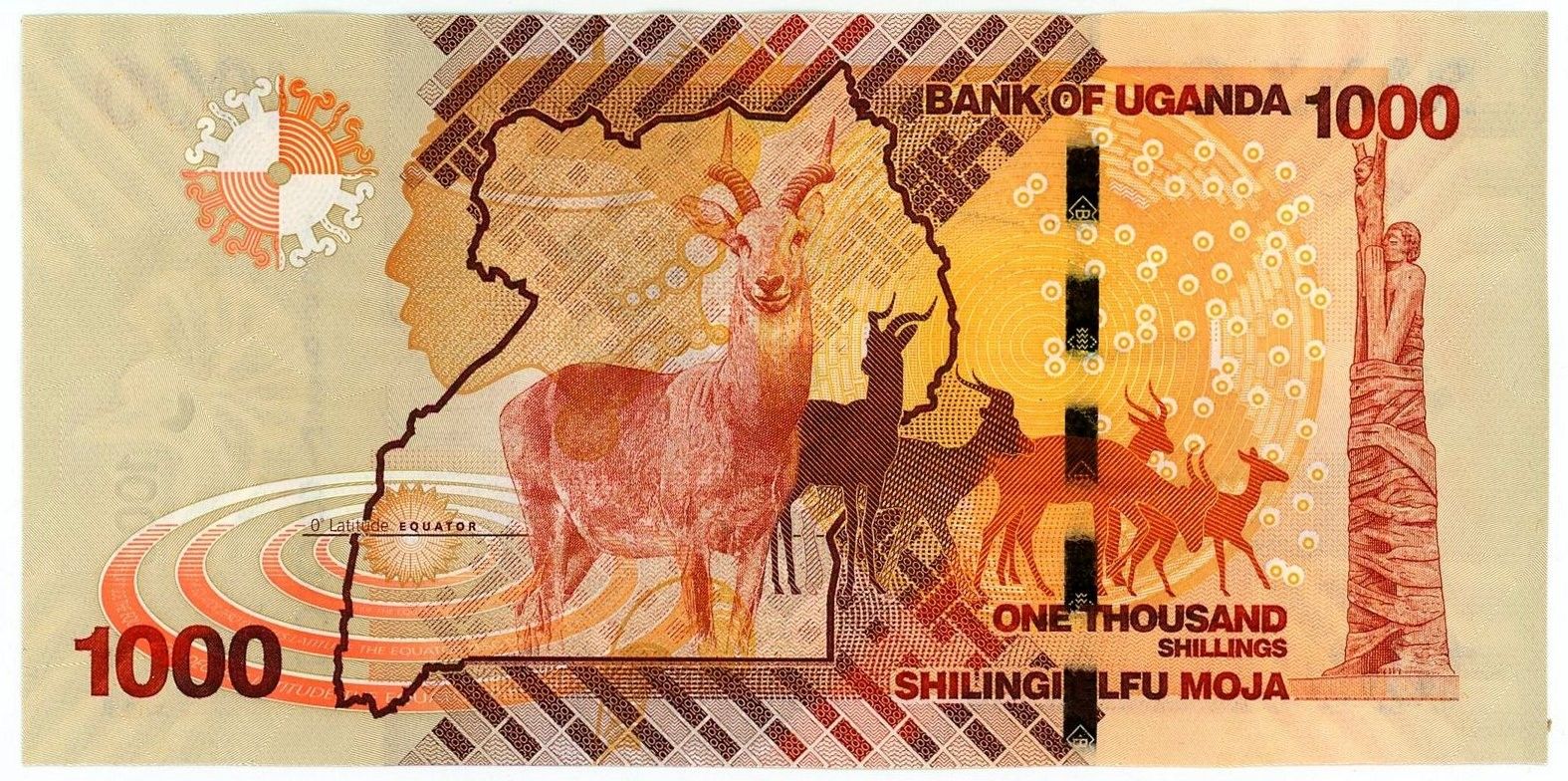

Bank of Uganda to completely phase out UGX1000 paper note in preference for coins

It’s no longer a question of what, but when. The government of Uganda says it will gradually phase out small denomination paper notes as one of the measures to reduce…

deneme bonusu veren siteler deneme bonusu veren siteler deneme bonusu veren siteler deneme bonusu veren siteler deneme bonusu veren siteler casino siteleri

deneme bonusu bonus veren siteler deneme bonusu veren siteler

flyjota.com Deneme bonusu veren siteler Deneme bonusu veren siteler Deneme bonusu

You cannot copy content of this page

gaziantep escort,alanya escort,gaziantep escort

avrupa yakası escort,beşiktaş escort,beyoğlu escort,nişantaşı escort,etiler escort,esenyurt bayan escort,beylikdüzü bayan escort,avcılar bayan escort,şirinevler escort,ataköy escort

beylikdüzü escort ,istanbul escort ,beylikdüzü escort ,ataköy escort ,esenyurt escort ,avcılar escort ,bakırköy escort ,esenyurt escort ,esenyurt escort ,avcılar escort ,beylikdüzü escort