|

Getting your Trinity Audio player ready...

|

Ever since she was a child, Natasha has been doing art. Her interest truly blossomed while at Makerere University where she was pursuing, ironically, a Bachelor of Commerce. But she spent most of her time perfecting her painting skills. After campus, she swapped the artboard for another hobby of hers.

“I got into interior designing, after doing a diploma in that field.” However, art came back calling. Around 2020, she discovered a new phenomenon that was sweeping across the world. It was digital art. She hang up her interior designing boots and immersed herself fully into digital art using Khashushu, which means pure in Rukiga as her artist name..

“Fortunately, COVID-19 came around, and with it came lockdowns. I had enough time to practice digital art until a friend mentioned NFTs ( Non-Fungible Tokens).” Natasha had never looked at art as an income stream, but more of a creative outlet. “The only way I would make money from art was through services like graphics and design, not selling NFTs. But a few months down the road, I started making money selling NFTs”

NFTs are essentially digital assets that represent real-world objects like art, music, in-game items, and videos. They are bought and sold online, often with cryptocurrency, and they are generally encoded with the same underlying software as many cryptos. As the name suggests, these tokens are non-fungible, meaning they are unique and cannot be replaced with something else. This is in stark contrast to fungible tokens, such as cryptocurrencies like Bitcoin or Ethereum, which are identical to each other and can be exchanged on a like-for-like basis.

The origin of NFTs can be traced back to 2012 with the creation of Colored Coins, which were small denominations of Bitcoin that could be “coloured” with specific attributes and used to represent real-world assets. However, the concept of NFTs as we know them today didn’t truly take off until 2017 with the launch of CryptoPunks and CryptoKitties, digital collectables that could be bought, sold, and bred on the Ethereum blockchain. These early NFTs paved the way for a broader understanding and acceptance of the concept, setting the stage for the explosion of interest we’re seeing today.

The NFT market experienced a significant boom in 2020 and 2021, with sales quadrupling to $250 million last year. This boom was fueled in part by the high-profile sale of several NFTs for astronomical sums. Perhaps the most notable of these was the sale of the NFT of the first-ever tweet by Twitter founder Jack Dorsey. The tweet, which simply read “just setting up my twttr,” was sold as an NFT for a staggering $2.9 million in March 2021. This event marked a significant milestone in the mainstream acceptance of NFTs and sparked a flurry of interest in the market.

The sale of Dorsey’s tweet was not an isolated incident. Around the same time, digital artist Beeple sold an NFT of his work for $69 million at Christie’s auction house, making headlines around the world. These high-profile sales have contributed to the perception of NFTs as a lucrative investment opportunity, attracting a wave of new investors to the market.

However, it’s important to note that the NFT market is highly volatile, with prices capable of swinging wildly in a short period. This volatility, combined with the relative novelty of the concept, means that investing in NFTs carries a significant level of risk. As with any investment, potential investors should thoroughly research the market and consider their risk tolerance before diving in.

Despite the risks, the potential of NFTs is undeniable. They offer a new way for artists and creators to monetize their work, and they provide a unique opportunity for collectors to own a piece of digital history. Moreover, as blockchain technology continues to evolve, the potential applications for NFTs are likely to expand.

Natasha breaks down how NFTs are made. “The process is pretty easy, but that is because I have been in Web III for a while. An NFT can be a picture or an audio or a video, basically anything that can be uploaded to the cloud. Once you have the asset you can go to platforms like Open Sea and open up an account, but you must have a crypto wallet. Then there is a process called minting.”

“Through minting, a digital asset like a picture is turned into an NFT. An NFT is like a key on the blockchain. It can be publicly seen, but it is unique. Once you mint it, you pay something called a gas fee. And then you have your NFT ready for sale.”

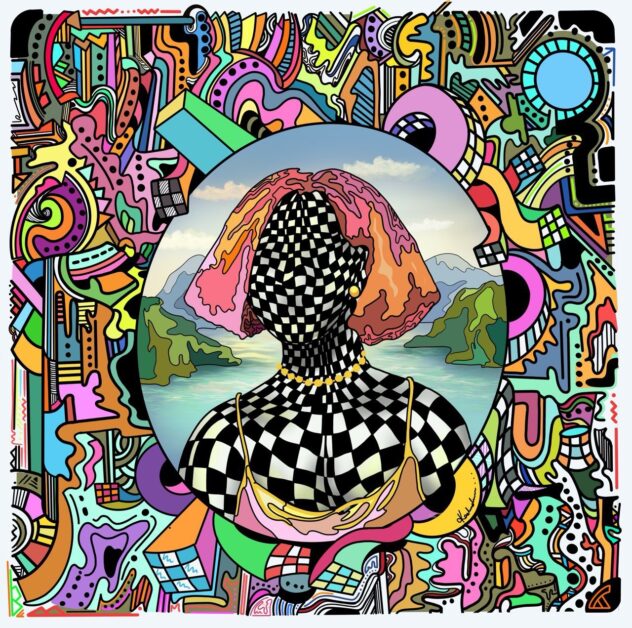

Natasha mainly does plain art and has sold about 15 already worth about 4 Eth (Remember, NFTs are sold using cryptocurrencies. Eth, short for Ethereum, is a cryptocurrency and 4 Eth was about $12,000 at that time.) She also co-founded projects like pineapples day out, the first generative art project in Africa that comprised of 5000 NFTs that were sold at 0.05 Eth each.

To get better at her work, Natasha has joined communities like the East African NFT Community, though it has mostly Kenyans. “Kenya is way ahead of Uganda in digital art. Recently, there was a Nairobi Design Week which was focused on the intersection of art and technology.” She is also a member of Afropolitan, a digital nation that is a network comprising the best that Africa and the diaspora has to offer across art, finance, tech, health, energy, sports, and media.

Natasha encourages more Ugandans to embrace digital art. “I don’t think anyone should prefer physical art over digital art or the other way round. Those are two different ways of showcasing work. But digital art has immense opportunities that physical art doesn’t. Digital art reaches more people across the world because everything is digital now. Marketing digital art is also cheaper with all the social media platforms and marketplaces like Open Sea. This makes selling even easier.”