According to the Economic Policy Research Centre (EPRC), Uganda’s leading think tank on economics and development policy-oriented research and analysis, 425,000 jobs were lost amongst Micro, Small and Medium Enterprises due to the Covid-19 pandemic. Of these, 241,000 jobs were lost between the period before Covid-19 and the end of the first Covid-19 lockdown, and 184,000 jobs were lost between the first lockdown and the second lockdown. Job losses were more prevalent among youth and female workers, and the magnitude of wage cuts was also higher for female and youth employees.

A determined Martha, decided to venture out into private business, setting up a farm produce dealing business in Odokomit, Lira City West, in Northern Uganda. To be able to, in her words, “keep a steady source of income”, she joined a savings group called Kisarwot, where has over the course of a year, accumulated some UGX1,000,000 (USD 278). With these savings, she has been able to inject more capital into her business.

Martha is one of the 1400 young agripreneurs supported under Cordaid Uganda’s Youth in Agribusiness programme. Cordaid is a Dutch international aid organisation that enables people to break through barriers of poverty and exclusion and live with dignity. Under this programme, Martha has received, among others, financial literacy training that has helped her catapult her business to new heights.

“Throughout the training, I was exposed to the culture and benefits of saving, even for tiny amounts of money. This opened my eyes to the money I was losing by not saving effectively, and how much it negatively affected my business,” she recalls.

Despite the many obstacles, Martha is preparing to take her business to the next level. She intends to use various marketing incentives to build and retain her client base, which is growing by the day. She also plans on leveraging social media to attract more clients, by creating and customising a digital marketing strategy for her company.

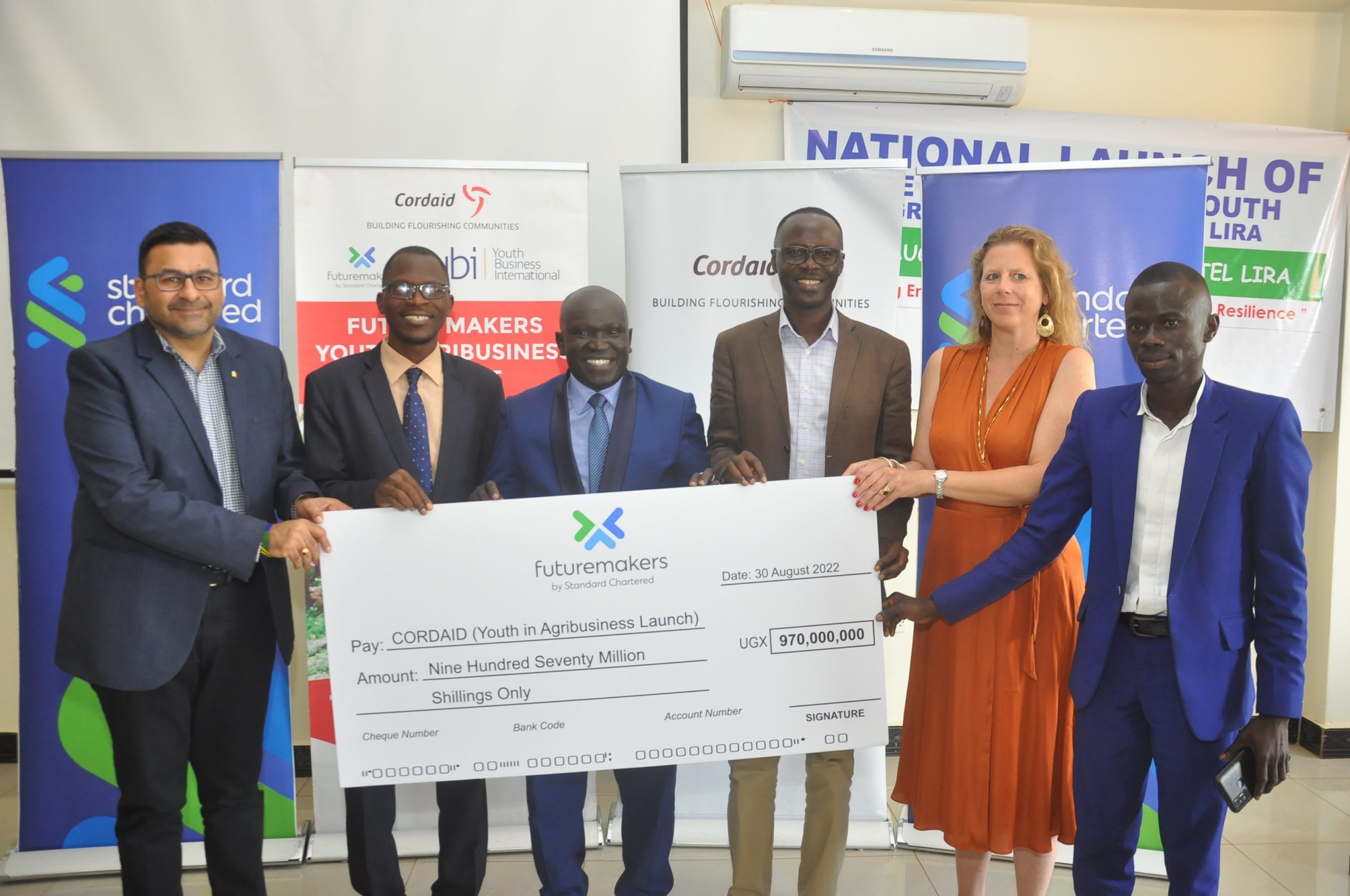

The Youth in Agri-business programme is a global initiative which tackles inequality by offering training in business development skills, mentorship, and market linkage to revive, strengthen, and build business resilience. In Uganda, the initiative, which runs in the districts of Lira, Nebbi and Zombo has so far received USD480,000 funding from the Standard Chartered Foundation’s Futuremakers programme.

“Futuremakers by Standard Chartered Foundation is our global initiative to tackle inequality by promoting greater economic inclusion in our markets. Futuremakers supports disadvantaged young people aged 35 or below, especially girls and people with visual impairments, to learn new skills and improve their chances of getting a job or starting their own businesses,” explains Margaret Kigozi, the Head of Corporate Affairs, Brand & Marketing at Standard Chartered Bank, Uganda.

“Through the Futuremakers Programme we have empowered the next generation to learn, earn and grow through programmes focused on three pillars – Education, Employability and Entrepreneurship,” she adds.

Through the education pillar, the Bank aims to empower 500,000 adolescent girls with life skills. Through the employability pillar, the Bank aims to deliver work readiness and vocational training schemes for 100,000 youth aged between 16 to 30, prioritising women and people with visual impairments. Standard Chartered Bank aims to provide training, capacity building and financing to 50,000 micro & small businesses through the entrepreneurship pillar.

Other than Cordaid, the Bank also funds three other projects i.e., Youth Empowerment, Entrepreneurship and Decent Employment (YEEDE) by the Voluntary Service Overseas (VSO); the Youth to Work programme by Challenges Worldwide, and the Goal Project by BRAC Uganda. Altogether, the Standard Chartered Foundation, the global charitable arm of the bank, has contributed funding of over USD 1.5 million (approx UGX5.6 billion) to different projects in Uganda.

Here for our communities, Here for Good

“As one of the leading banks in the financial sector, our vision is to become a sustainable, responsible bank in Uganda. We are on the journey to becoming an industry leader in sustainability, well recognised by our clients and other external stakeholders and working with the private sector as a catalyser of finance for the Sustainable Development Goals (SDGs),” says Sanjay Rughani, the Standard Chartered Bank Uganda Chief Executive Officer.

He explains that the bank’s sustainability agenda is underpinned by three bold stands that the Bank committed to achieving in 2021, namely: Accelerating Net Zero, Lifting Participation and Resetting Globalisation.

“Accelerating Net Zero is about helping our markets to reduce carbon emissions, putting us on a sustainable path to become a key player in the race to reach net zero with two commitments i.e., to achieve net zero emissions from our operations using renewable energy sources by 2030 and to achieve net zero in our financed emissions by 2050. Under this initiative, Standard Chartered has committed to providing clean energy to 1 billion people in Africa, Uganda inclusive,” reiterates Rughani.

Under the Lifting Participation initiative, the Bank has committed to “improve the lives of 1 billion people globally and their communities by unleashing the full potential of women and small businesses by accelerating the provision of quality financial services to women across our footprint, purposefully connecting SMEs to international markets and building partnerships to expand the reach and scale of financial services”.

“Under the Resetting Globalisation agenda, we have committed to supporting 500,000 companies to improve working and environmental standards. We are giving everyone a chance to participate in the world economy so that growth becomes fairer and more balanced,” adds Rughani.

For example, under the Empowerment and Livelihood for Adolescent (ELA) program, a component of the Goal Project, itself, a community investment initiative which uses sports and life skills education to transform the lives of young women and girls, the Bank is working with BRAC Uganda to empower girls with financial education and life skills so that they can play active leadership roles in their families, communities, and economies.

For 17-year-old, Mutoni, who after completing Primary Seven, had to drop out of school to pave way for her siblings an opportunity to at least complete primary school education, due to school fees constraints, the ELA program has given her another shot at life, keeping her dreams alive.

Mutoni had a dream of becoming a great nurse in the future but dropping out of school shattered her dreams. But under the ELA program by BRAC Uganda which empowers young girls and women from vulnerable communities and families with life skills, sports, livelihood training and financial literacy to transform their lives and carry-on leadership roles in their families and communities, she is beginning to pick up the pieces. From the day she joined the program, thanks to a tip and encouragement from her friend who is already a member of the Mpoma Club, she was able to join the club. She can now earn some money through weaving mats which she sells to the people in and outside her community. She uses her little money to buy her personal needs like pads, and clothes, supports her siblings and saves some little money for her future use and possibly returning to school to pursue her dreams.

Since its inception, in 2014, BRAC Uganda’s Goal project has impacted the lives of over 42,000 adolescent girls in rural and urban communities. The project has 56 established safe spaces in 56 villages/communities across 7 districts and over 35,00 community leaders have been engaged.

The project has also established over 550 businesses for Adolescent girls and Young Women and over 28,000 parents and caregivers were reached through parents’ meetings and mothers’ forums. The program has also built capacity for over 217 peer leaders/ mentors.

Under the accelerating net zero in our communities agenda, the Bank last year heldthe Climate Change Innovation Challenge with 30 schools. The Challenge’s finals were held at Gayaza High School on 8th July 2022.

‘The purpose of the Innovation Challenge was to promote Climate and environmental awareness by inspiring students as catalysts for positive climate change solutions. The top 5 schools were awarded USD1,000 each to implement the winning ideas,” says Ms. Kigozi.

“We also planted 30,200 trees in Kasese and the Albertine region in partnership with the Environmental Conservation Trust of Uganda & Buhimba Farmers Union,” she adds.

The Bank is also engaging its staff in various volunteer engagements, especially on tree planting.

“In 2022, we had 48% of staff participation (154 volunteers), volunteering their time in various community initiatives,” she further says.

Unleashing the full potential of youths, women and small businesses

Before applying to Youth to Work, Vincent was unemployed for about a year after he lost his job in March 2020 due to the Covid-19 pandemic. During that time, he was applying for job opportunities, and that’s how he landed on Youth to Work opportunity. He found out about the programme from an advert on the Internet

Vincent was placed at House of Rehoboth Uganda Limited in Maganjo, Wakiso District. House of Rehoboth is a manufacturing company that manufactures detergents and disinfectants like hand sanitiser, hand wash, liquid soap, and other cleaning products. 100% of the company staff are young people, including the owner. House of Rehoboth also supports the youth as part of the Youth to Work program.

As a Junior Associate, his main aim at the enterprise was to improve its management, sales, and marketing strategies. He introduced Social Media Marketing, and the organisation started running Facebook ads. He also opened an online shop on Jumia, and their products benefited from digital visibility. All the above strategies increased company sales to a record high of UGX50 million The proprietor believed in his abilities and always endorsed his ideas with all the support he needed.

“Challenges Worldwide Uganda has enabled youth to get employable skills. It opened doors that have taken me from Junior Associate to Manager of House of Rehoboth, and now to working with Mastercard Foundation.”

“As Standard Chartered Bank we believe everyone deserves the opportunity to realize as well as optimally fulfil their potential and that is why we scaled up the “Youth to Work” programme with UGX430 million after an initial investment of UGX920 million we made in 2021,” Rughani tells CEO East Africa Magazine in an interview.

“In 2022 our development partners ‘Challenges Worldwide’ ensured 45 Junior Associates were supported through placements in SMEs. The 32 SMEs that were recruited were also supported through masterclasses to empower them with skills such as audit readiness and financial literacy. The Programme continues to focus on the personal and professional development of the Junior Associates with an emphasis on career development,” he adds.

In total, 198 out of 205 young graduates have benefited directly from the programme⏤ of these, 50% were females and 50% were males, and 8.5% were Persons with Disabilities.

79% of the trained beneficiaries have reported remaining in decent employment after six months post-placement, while 12% have started their own entrepreneurship ventures. Overall, 100% of the beneficiaries have reported and demonstrated an increased level of confidence and self-esteem related to employment knowledge and skills.

121 enterprises out of 138 have directly participated in the programme to date and of these, 84% have demonstrated improved perceptions of the abilities and potential of young people.

While the programme initially targeted 2,800 young people under the non-intensive reach, 3,695 young people indirectly benefited from the programme through training organised and facilitated by the Junior Associates. Out of these, 2,546 were females and 1,149 males.

“Blindness did not hinder my abilities”⏤ the story of Alfred Wamani

Alfred became blind during the Covid-19 period. His blindness was an outcome of an operation that did not go as planned after which he was declared blind for life.

With support from his guardian, in 2021, he enrolled at the Uganda National Association of the Blind (UNAB) to, in his words: “reskill myself since my previous teaching skills needed a boost to fit into my new life”.

“My goal was to study braille and ICT so I can transition into teaching my fellow PWDs with ease,” he reminisces.

During his enrolment, he got to know about the Youth Empowerment, Entrepreneurship and Decent Employment (YEEDE) by Voluntary Service Overseas (VSO). Funded by Standard Chartered Foundation, the project focuses on the economic inclusion of 1000 young people (60% women, and 10% PWDs) through creating improved employability, entrepreneurship, and strengthening the enabling environment for entrepreneurship and jobs.

With the help of YEEDE, Alfred formed a financial saving group of 17 members called Kireka Progressive Development Association (KPDA) and is the chairperson of the group.

“Our initial saving collection on the first day of sitting was UGX70,000, in July 2021, and as of today, membership has grown to 25 members, 22 of whom are PWDs, and five non-PWDs. Our accumulative total collection has grown to UGX754,900, with UGX254,900 in cash, and about UGX500,000 in loans,” he recalls.

YEEDE, which is active in Kampala and Wakiso districts has enabled 100 youth ⏤ 76% female, 8% PWD and 3% visually impaired, to complete market-based employability training. Of these, 96 have been certified and accredited by the Directorate of Industrial Training⏤ 73 female, 23 male. 6 of these (5 male and 1 female) were PWDs ⏤ 2 male and 1 female, have a visual impairment.

The project has also secured internship placement for 88 youths (78 female and 10 male) who had been undergoing skilling training. 547 youth (350 female and 197 male) received business mentorship and financial literacy training.

A cumulative total of UGX 74 million (USD 20,555) has so far been raised, using the Business Savings and Loan Association model with 22 groups, generating a cumulative UGX 54 million (USD 15,000) loan fund. The youth created their own resources from which they get loans to either start or improve their businesses. Additionally, 12 youths have been linked to formal financial institutions to access financial services and products.

The Capacity of Youth Networks (NYEN) was strengthened through training in leadership, advocacy and decent work, supported at the community and policy levels.

YEEDE has also developed a position paper on disability inclusion into the Employment Act Amendment Bill 2022 that was submitted to the Ministry of Gender, Labour and Social Development, as well as the Parliament of Uganda.

“True to our brand promise Here for Good, for 111 years now and beyond, we are and will continue to be committed to sustainable social and economic development through our business, operations, and communities,” reaffirms Rughani

dfcu Bank and Monitor Publications Crown Season 7 Rising Woman Champions, Celebrating Uganda’s Top Women Entrepreneurs

dfcu Bank and Monitor Publications Crown Season 7 Rising Woman Champions, Celebrating Uganda’s Top Women Entrepreneurs